Learn About Medicare

Making the Most of Your Medicare Benefits: A Guide to Navigating Medicare With Confidence

Navigating the process of selecting and using your Medicare coverage can be challenging, but Patient Advocate Foundation is here to help. This guide provides you with the information and confidence to make informed decisions, advocate for yourself, and take full advantage of your Medicare benefits. Click on the bars below to read chapter summaries as well as access the full chapter from our comprehensive guide.

Medicare is a federal health insurance program overseen by the Centers for Medicare and Medicaid Services (CMS). It provides coverage for individuals 65 and older, those on Social Security Disability Insurance (SSDI) for more than 24 months, and individuals with End-Stage Renal Disease (ESRD) or amyotrophic lateral sclerosis (ALS). Medicare offers different parts, including Part A (hospital bills), Part B (medical bills), Part D (prescription bills), and Part C (Medicare Advantage Plans). Additionally, Medicare Supplement Plans (Medigap) are available to fill coverage gaps left by Original Medicare.

To read this chapter, click here, or to view the complete guide, click here.

Medicare eligibility depends on factors such as age, citizenship or residency status, work history, and specific medical conditions. It's important to understand all of your options for enrollment and the rules for each part: Parts A, B, and D, Medicare Advantage, and Medigap plans.

To read this chapter, click here, or to view the complete guide, click here.

Medicare Part D is optional prescription drug coverage available to everyone with Medicare. It can be obtained through two options- a Medicare drug plan or bundled with a Medicare Advantage Plan. Before making a selection, it is important to consider factors such as formulary coverage (are your medications covered and if so at what cost), out-of-pocket costs, pharmacy options, and coverage phases. Once you choose a plan, you must stay in it until the next Open Enrollment period each year on October 15th.

To read this chapter, click here, or to view the complete guide, click here.

Medicare Part A pays for medications during a Medicare-covered hospital or skilled nursing facility stay, while Part B covers drugs administered by a healthcare provider in settings like doctor's offices or outpatient facilities. Part B also covers intravenous treatments, tube feeding, and certain drugs related to organ transplants. If you're unsure about coverage, consult your doctor or contact your drug plan for clarification.

To read this chapter, click here, or to view the complete guide, click here.

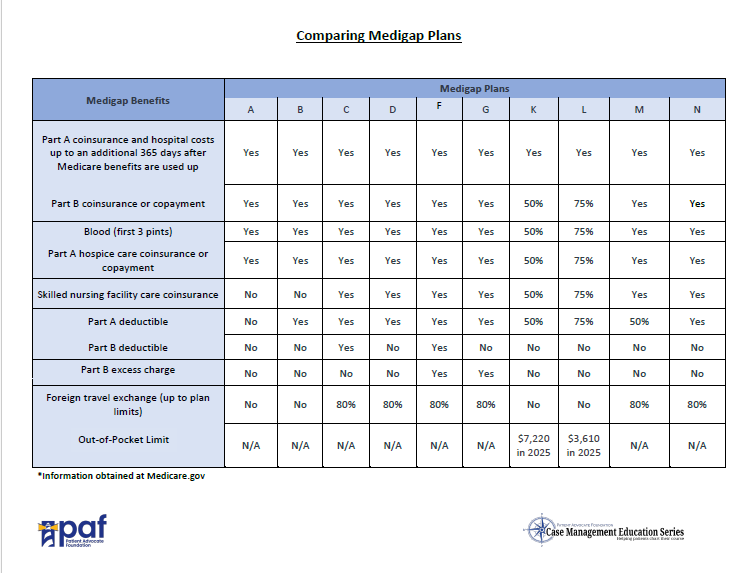

Medicare Supplement (Medigap) policies are private insurance plans designed to help cover the out-of-pocket expenses that Original Medicare doesn't fully cover, such as deductibles, copayments, and coinsurance. Some states have different options, but in general, there are ten options labeled A, B, C, D, F, G, K, L, M and N. It's important to choose a Medigap plan that suits your needs and current and future healthcare needs and your financial situation.

To read this chapter, click here, or to view the complete guide, click here.

When selecting the best Medicare option for you, take time to make an informed decision. Consider factors such as the plan's costs, your medical needs, your prescribed drugs, and coverage for your providers. For Medicare Advantage Plans, be aware of the out-of-pocket costs, network restrictions, and prescription drug coverage. Utilize resources like the Medicare.gov Plan Compare tool to compare different plans and their coverage in your area.

To read this chapter, click here, or to view the complete guide, click here.

Medicare enrollment periods include an Initial Enrollment Period, Annual Open Enrollment, General Enrollment Period, and Special Enrollment Periods. It's important to understand each period's specific dates and conditions to ensure timely enrollment and avoid potential late enrollment penalties.

To read this chapter, click here, or to view the complete guide, click here.

When applying for Medicare, if you're already receiving Social Security or Railroad Retirement Board benefits, you're automatically enrolled in Part A. If you're not receiving benefits, you need to sign up for Medicare Part A and B through the SSA.gov website or by contacting Social Security. Coverage begins based on when you sign up, with Part A starting the month you turn 65 and Part B based on your enrollment month. After the Initial Enrollment Period, you can sign up during the General or Special Enrollment Period. Additionally, you can choose to enroll in Part D, a Medigap policy, or a Medicare Advantage Plan simultaneously.

To read this section, click here, or to view the complete guide, click here.

Know your coverage start date which depends on when you signed up. Once you sign up for Medicare, you will receive a Medicare card with your welcome packet. If you elected Part D, a Medicare Supplement or Medicare Advantage you will receive separate insurance cards for those coverages. You will next check if your provider accepts Medicare (or Advantage plan if applicable) and be aware of services covered vs not covered. If applicable, also coordinate benefits with other health coverage you may have as there are rules that decide which one pays first. Be sure to tell providers about all medical and drug insurance plans you have to ensure your bills are paid in the correct order.

To read this section, click here, or to view the complete guide, click here.

When facing a denial of Medicare coverage, you may have the option to appeal the decision through a multi-level process. There are five levels of appeals with each level based on a specific dollar amount of the claim. The five levels include: Redetermination, reconsideration, administrative law judge (ALJ) hearing, appeal to Medicare appeal council, and appeal to federal district court.

To read this chapter, click here, or to view the complete guide, click here.

There are many agencies in place to help people navigate Medicare benefits, Medicare complaints, and ensure quality of care as well as health and safety standards. The State Health Insurance Assistance Program (SHIP) provides free one-on-one assistance to help eligible individuals understand their Medicare coverage, evaluate benefits, explore plan options, offer guidance on Medicare rights and help find financial support for prescription medications. Medicare Beneficiary Ombudsmen (MBO) work alongside SHIP to help with Medicare-related complaints, grievances, or appeals. Additionally, Beneficiary and Family-Centered Care Quality Improvement Organizations and State Survey Agencies oversee healthcare facilities, by handling quality of care complaints, and ensuring health and safety standards are met.

To read this chapter, click here, or to view the complete guide, click here.

Patients have access to a range of additional Medicare programs, plans, and savings options including Medicare Savings Programs, Extra Help for prescription costs, PACE (Program for the All-Inclusive Care for the Elderly), Medicare Cost Plans, Medicare Medical Savings Account Plans (MSA), Special Needs Plans (SNP), and Demonstration and Pilot Programs. These programs aim to offer individuals ways to access essential healthcare services while effectively managing expenses and/or direct assistance to help pay for premiums, copays, coinsurance, etc.

To read this chapter, click here, or to view the complete guide, click here.

A glossary of key terms defines words associated with Medicare in an easy way so Medicare recipients can familiarize themselves or reference as they come across them through their healthcare journey using Medicare.

To read this section, click here, or to view the complete guide, click here.

This Medicare resources guide provides a comprehensive list of financial assistance programs, local/national help organizations, health insurance-related resources, and contact information. These resources can connect patients with assistance for various needs, including copayment assistance, additional Medicare financial assistance, finding local and national help, understanding health insurance, and accessing relevant agencies and programs.

To read this section, click here, or to view the complete guide click here.

Webinars & Interactive Trainings

Publications & Tip Sheets

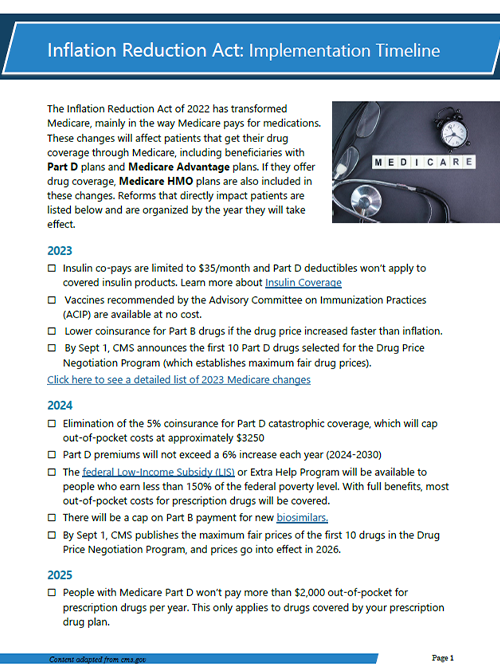

The Inflation Reduction Act of 2022 affects everyone on Medicare. See what changes have been implemented for Medicare beneficiaries since 2023, as well as what’s to come.

Explore informational and cost-saving resources for Medicare beneficiaries from state and national sources.